nanny tax calculator canada

WE TAKE CARE OF. Cost Calculator for Nanny Employers.

How To Pay A Nanny Caregiver In Canada Net Vs Gross Vs Out Of Pocket Nanny Payroll Tax Service For Households With Employees Heartpayroll

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again.

. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Employer Out of Pocket Expense. Enter your pay rate.

When caregivers are paid on the books they gain access to unemployment insurance social security medicare. Nanny Wage 40 hrs week. Key in basic data like the hourly wage and get an estimate of how much you will have to pay per month and per year.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables. Calculate your caregivers pay now. If you hire a caregiver baby-sitter or domestic worker you may be considered to be the employer of that person.

Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year. The Nanny Tax Company has. Put values into the required input fields marked with an and optionally.

If you require standard assistance our Starter package is. The amount can be hourly daily weekly monthly or even annual. NannyTax offers three domestic payroll tax plans giving you the flexibility to choose the package and price that best works for you.

Social security nanny. 5000 per child for children aged 7 to 16 years. 000070 State tax paid.

Canadian taxpayers can claim up to 8000 per child for children under the age of 7 years at the end of the year. As an employer you have responsibilities in the employment relationship. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes.

Use our nanny payroll calculator. Were here to help. Our new address is 110R South.

The calculator is updated with the tax rates of all Canadian provinces and territories. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. In TurboTax you must enter the payments as Estimated payments and they will get applied correctly to submit to the IRS.

Nanny Take Home Pay. Federal tax paid. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator.

As you may know you can deduct child care expenses including a nanny against your eligible employment or self-employment income. Then print the pay stub right from the calculator. Nanny Tax Schedule H in TurboTax.

Paying your nanny via direct deposit. The Nanny Tax Company has moved. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two.

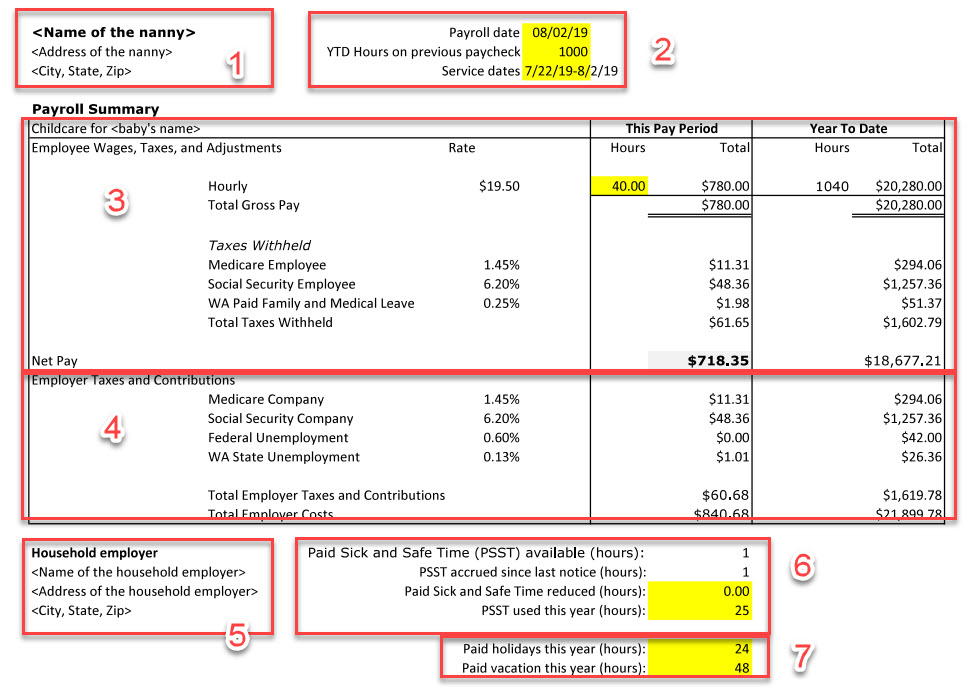

Calculation of net and gross pay taxes CPP and EI amounts. 002000 Extra per check. As an example for a nanny who works 40 hours a week the gross annual salary at the new minimum wage of 14 an hour will need to be at least 29120 14 x 40 hours x 52.

005000 Local tax paid. Net Pay of 500week. Nanny Take Home Pay.

Canada Revenue Agency CRA registration. 01500 State unemployment employee. For tax year 2021 the taxes you file in 2022.

You can claim up to 8000 for each.

Nannytax Nannytaxcanada Twitter

Nannytax Nannytaxcanada Twitter

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

How To Calculate Nanny Payroll Taxes Canada Ictsd Org

Nanny Payroll Tax Services Canadian Nanny

How To File Taxes In 2022 Tax Filing Tips Debt Ca

Nannytax Nannytaxcanada Twitter

How To Pay A Nanny Caregiver In Canada Net Vs Gross Vs Out Of Pocket Nanny Payroll Tax Service For Households With Employees Heartpayroll

Make Taxes Easier To File With A Nanny Payroll Tax Calculator Tax4nanny Ltd

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

How To Save Taxes For Self Employed In Canada